It is Time to Use AI to Modernize Call Recording Review and Supervision

Audio recording has been commonplace for the financial services industry due to longstanding regulatory requirements.

But three, key factors have recently brought about significant shifts for audio recording requirements:

- MiFID II expands what needs to be recorded. FIs must record both phone and electronic communications for investment service.

- New privacy requirements like EU GDPR means you need more understanding of what is in your recordings.

- Increases in accountability including risks of fines and more for individual compliance professionals. A recent compliance study found 54% of respondents expect their personal liability to increase in the next 12 months.[i]

With the rapidly growing archive of call recordings that FIs have, firms of all sizes must adopt more review of their audio and video call recordings.

Here are three steps to simplify the path to audio recording supervision:

- Have a plan to expand your call recording

Move beyond simple transaction recordings with best practice of covering audio and video recordings for product and offering discussions. Recording enough calls also avoids providing a guided path to conduct risk.

- Establish a review process that doesn’t rely on transcripts alone

Create an auditing plan to review recordings at regular intervals and identify the reviewers to include in the process. It’s common to review 10 – 20% per quarter and technology that prioritizes your highest risk recordings to review is ideal.

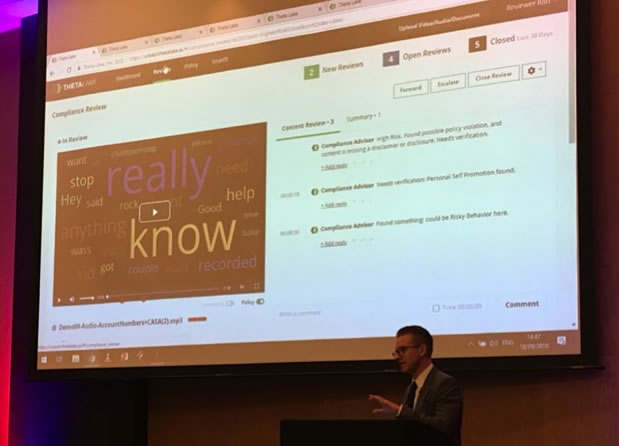

- Streamline review and supervision with technology

The right technology can help. A word of caution: be careful not to append transcription review alone to your existing supervision process. Even adding a recording and its transcript to legacy systems causes accuracy issues and extra manual effort.Adopt a review solution that integrates with your call infrastructure and uses AI to gain cognitive insights on risks in recordings and automate manual tasks for your reviewers for modern audio (and even video) supervision. This ensures accuracy whilst saving time in analyzing audio content for compliance teams to reduce risk and improve customer trust.

[i] Thomson Reuters. Cost of Compliance 2018. June 2018.