Beth Wood, SVP & CMO of Principal Financial Group, joins Theta Lake’s CEO Devin Redmond at InsureTech Connect 2019 to discuss the compliance challenges for new digital communications like personalized videos and web conferencing.

Importance of Video Marketing

Video is a major part of today’s marketing strategies, and for good reason. Customers prefer video and employees want to engage with customers and prospects on their preferred channel. This has lead to 87% of businesses now using video as a marketing tool, growing from 63% in 2017. The benefits are huge, particularly in financial services, where it’s an effective way to get a message across clearly and easily.

Social media and personalized outreach are two common ways marketers are utilizing video content. Video offers a richer experience to stand out in the loud crowded landscape of social media. And social videos offer a strong ROI: 93% of marketers say they’ve gained a new customer thanks to a video on social media.

Personalized videos enable reps to create short form content for client relationship building. By talking with or to the specific needs of their customer, sales reps build more authetenic relationships.

of businesses now use video as a marketing tool, growing from 63% in 2017

Increasing Oversight is Required

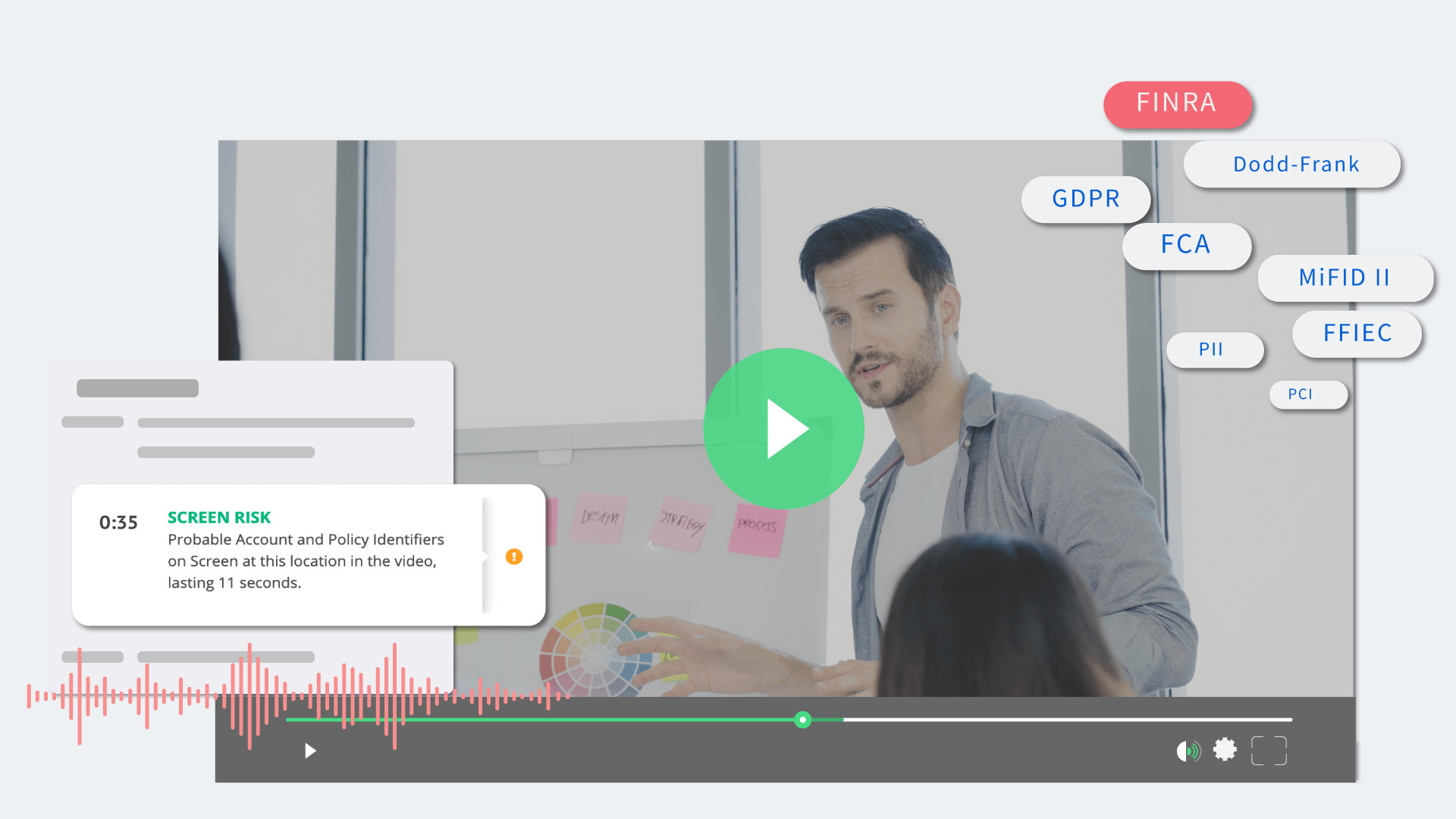

However, with this move to video, voice and web conferencing comes a new challenge – the need to ensure that the content is compliant with external regulations and corporate policies.

Regulated industries such as banking, securities. finance, insurance, and others related to consumer credit have been dealing with an increasing number of regulations. Rules covering data, disclosures, and privacy– such as SEC 17a-4, EU MiFID II, and GDPR–are being added on top of regulations designed to protect investors and to monitor financial institutions — such as FINRA and FFIEC. Non-compliance costs for the typical enterprise is $14.8 million annually.

”The challenge when you think about all these new ways to engage customers is how do we look at video at scale?

Beth WoodSVP & CMO, Principle Financial Group

The Compliance Challenge for Marketing

Compliance managers face the challenge of scaling limited resources to meet the demand of marketing teams wanting quicker review turnaround while also meeting stricter regulation standards.

Increasing communication output in a variety of channels, and in a largely manual environment, creates a huge demand on compliance to do more, often with the same resources. Scaling compliance capabilities with speed and accuracy is becoming an increasing area of focus for organizations.

Best Practices for Video Marketing Compliance

- Clear pre-review and post-review processes

Pre-review process may include marketing providing scripts for compliance review before production. This way, risks can be flagged before time and resources are invested.

Post-review process includes how your organization will archive videos with regulatory requirements in mind. Archiving might include storing your videos with their associated scripts, dates of use, and reviewer’s notes. Furthermore, videos should be stored in search-ready format for audit scenarios and align with your company’s overall retention policy rules.

- Video compliance technology should be independent, yet integrate with marketing tools

The right video compliance software should provide integrations across all channels your videos are being used. This includes social media channels like YouTube and Vimeo, personalized sales videos created in Vidyard GoVideo or Videolicious, or broader web conferencing services like Cisco Webex Meetings or Zoom Meetings.