Easing Compliance Supervision Challenges for PRIIPs KID Verifications

The EU Regulation on Key Information Documents for Packaged Retail and Insurance-based Investment Products came into effect on January 1, 2018. Since that time, financial services firms have been grappling with a host of new documentation and notification requirements. Specifically, firms must now make available a standardized Key Information Document (“KID”) to retail customers “in good time before any transaction is concluded,” which generally means sometime prior to the culmination of the purchase of any in-scope Packaged Retail and Insurance-based Investment Product (“PRIIP”). In basic terms, whenever an investment adviser, broker or representative recommends an investment product or insurance policy like certain unit trusts, derivatives, or annuities with fluctuating returns, they must provide a KID to the prospective investor before executing the sale.

The KIDs must follow a uniform format and cannot exceed three pages. KIDs outline the risks specific to investing in a particular PRIIP as well as information about potential returns from the product and details on how to lodge complaints. The specificity of these content and formatting requirements convey the EU’s emphasis on transparency, clarity and simplicity as key components of investor protection. According to the Regulation, anyone offering PRIIPs—whether a manufacturer, partner, distributor, or other third-party—is bound by the requirement to distribute KIDs. Firms offering PRIIPs in any capacity must abide by these new rules.

The FCA has oversight and enforcement responsibility for PRIIPs in the UK, and the potential consequences for non-compliance with KID distribution requirements are severe—up to €5 million or 3% of the manager’s total annual turnover. Given the amounts of potential fines, firms have dedicated significant efforts to updating business processes and documentation to comply with the rules. Many firms are leveraging Web pages and email systems as the mechanisms for delivering KIDs to retail investors.

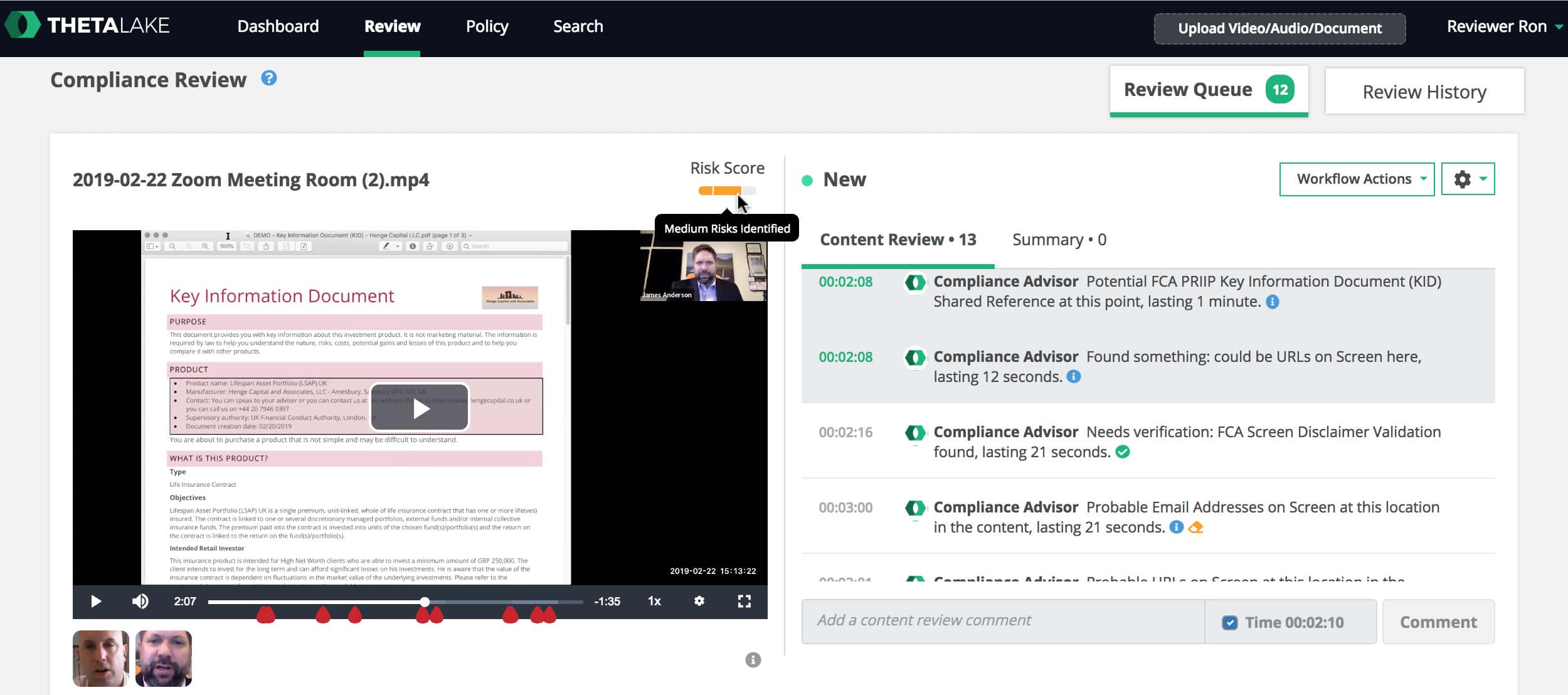

However, oversight of individuals engaged with retail investors and validation that KIDs are being provided in all instances is challenging given the state of available supervision tools. KIDs may be referenced during phone calls or videoconferences with representatives, and firms lack transparency into the contents of those conversations. Recent MiFID II mandates expanding the scope of voice recording for investment conversations are an additional complicating factor as firms are now tasked with supervision of an ever-increasing amount of data. Between PRIIP and MiFID II firms have an increased supervisory burden related to their multimedia content and must find a manageable surveillance mechanism . At Theta Lake, we’ve enhanced our platform to detect KID and other PRIIP-related information. Theta Lake’s software presents results in an intuitive interface where each potential violation is pinpointed on an audio or video timeline, enabling reviewers to focus on sections of the recording that present the most risk.

Our audio classifier parses conversations to determine if the KID has been discussed in the context of a PRIIP conversation. The Theta Lake application surfaces statements about the KID, the mention of a web site containing the KID, or if a commitment to send the KID has been made. Our video detection algorithm identifies the text of the KID itself as well as URLs linking to the document. The video module analyzes any viewable content and detects KID- and PRIIP-related information regardless of how it may have been shared. The platform recognizes information viewable over a screenshare, instant messaging window, or file sharing application.

The ability to detect and escalate KID and PRIIP discussions for review using Theta Lake’s AI-enabled workflow allows firms to proactively focus on the legal and regulatory risks associated with these conversations. Theta Lake’s application audits every step of the review process, generating concrete, actionable evidence of identified issues that drive internal escalation processes and provide regulators and auditors meaningful insights into a firm’s compliance control framework. Theta Lake’s platform facilitates smarter, more efficient supervision of PRIIP-related audio and video content.

To learn more about the Theta Lake’s platform and its PRIIP and KID capabilities please contact info@thetalake.com.