The U.S. Securities and Exchange Commission (SEC) and the Commodity Trading Futures Commission (CFTC) have widened their investigations and fined another series of firms for recordkeeping failures. As with previous recordkeeping breaches, the firms concerned failed to stop employees, including those at senior levels, from communicating using unapproved communication methods, including messages sent via personal text and WhatsApp. The total monetary penalties imposed is now more than $2.6bn.

The CFTC imposed a fine of $20m (download CFTC article here) on an introducing broker and a futures commission merchant in the same group for failing, since at least 2019, to maintain and preserve records that were required to be kept under CFTC recordkeeping requirements. The order also found the widespread use of unapproved communication methods violated the firm’s internal policies and procedures, which generally prohibited business-related communication taking place via unapproved methods. Further, some of the same supervisory personnel responsible for ensuring compliance with the firm’s policies and procedures themselves used non-approved methods of communication to engage in business-related communications, in violation of firm policy.

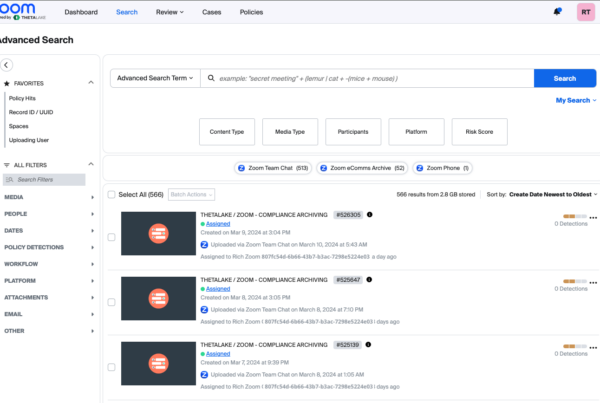

The SEC enforcement actions were against five broker-dealers, three dually registered broker-dealers and investment advisers, two affiliated investment advisers and, separately, two credit rating agencies all for widespread and longstanding failures to maintain and preserve electronic communications. The combined penalties were $79m for the 10 firms and then another $10m for the recordkeeping failures at the credit rating agencies. The SEC’s investigations uncovered pervasive and longstanding off-channel communications whereby employees communicated through personal text messages. The firms did not maintain or preserve the substantial majority of these off-channel communications, in violation of the federal securities laws. By failing to maintain and preserve required records, certain of the firms likely deprived the SEC of these off-channel communications in various SEC investigations. As with the CFTC findings, the failures involved employees at multiple levels of authority, including supervisors and senior managers, which appears to have invoked the ire of both the SEC and CFTC.

The SEC made a particular point that one firm had a substantially reduced fine for self-reporting the issue – “One of the orders included in today’s announced actions is not like the others,” said Gurbir S. Grewal, Director of the SEC’s Division of Enforcement. “There are real benefits to self-reporting, remediating and cooperating.”